Impact of Social Media on Moroccan Perceptions of Price Increases

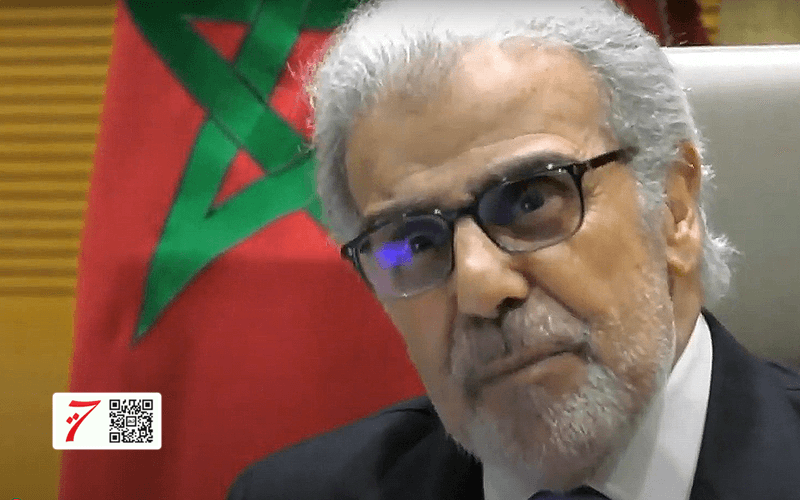

Abdelatif Jouahri, the Governor of Bank Al-Maghrib, highlighted the significant influence of social media on Moroccans’ perceptions regarding rising prices, particularly for food items. He noted that these platforms have exacerbated a human tendency to focus on price increases rather than decreases.

Responding to a query about the discrepancy between inflation figures and public sentiment regarding prices, Jouahri emphasized the need to distinguish between "inflation" and "the price" of food products. He explained that there is an approximate 8% difference between the two, as inflation figures reflect a specific period based on consumption indices, unlike daily market prices.

Inflation: Official Figures vs. Real Life

According to Jouahri, inflation is defined as the continuous increase in the average prices of goods and services over a specific period. This definition relies on precise measurements considering a consumption basket representing the average citizen. However, these figures do not always reflect the realities faced by the average person.

In Morocco, essential food items account for about 40% of the consumer price index, a notably higher percentage compared to developed countries where it does not exceed 5% to 7%. This disparity underscores the nature of the Moroccan economy, which heavily relies on basic food consumption, making price increases in these items highly significant for individuals.

Jouahri pointed out that inflation does not solely imply rising prices for one or a group of goods; it represents a change in average prices over time. However, many citizens struggle to distinguish between "price increases" and "inflation," leading to a general perception that official numbers do not reflect reality, especially when individuals feel immediate financial pressure from rising prices of essentials like bread, oil, or vegetables.

Role of Social Media in Shaping Perceptions

In this context, social media plays a crucial role in amplifying feelings of economic distress. Platforms such as Facebook, Twitter, and Instagram allow Moroccans to share their daily experiences related to price increases, contributing to a collective sense of economic hardship. These platforms have become spaces for expressing dissatisfaction, where users share images of high bills or price comparisons between different markets. Such interactions create a kind of "virtual inflation," instilling in people the belief that rising prices are the norm, even if official figures indicate a notable decline in the inflation rate during certain periods.

For example, a citizen may post a photo of a shopping receipt showing a spike in the price of a specific food product, sparking widespread discussions and angry comments. While these posts reflect individual experiences, they contribute to a general impression that prices are perpetually rising, regardless of whether these increases are seasonal or linked to external factors like fuel price fluctuations or droughts. This media amplification complicates the ordinary citizen’s understanding of the official numbers presented by Bank Al-Maghrib, widening the gap between economic reality and public perceptions.

Challenges of Economic Communication

One major challenge facing Bank Al-Maghrib is effectively communicating economic data in a manner that makes it relatable and comprehensible to the public. The average citizen may not prioritize inflation rates or average prices but focuses on everyday expenses: the cost of bread, transportation fees, or electricity bills. This emphasis on individual experiences complicates the effectiveness of economic policies when discussing “declining inflation” amid growing financial pressures.

Jouahri called for a clear distinction between rising prices and inflation, pointing out that this confusion is a root cause of misunderstanding. However, making such distinctions requires significant educational efforts, including using direct and simple language to communicate with the public. Institutions could leverage social media platforms to disseminate reliable economic information, transforming them from venues for rumors or misinformation into tools for clarifying economic concepts and explaining figures in ways that resonate more closely with citizens’ concerns.