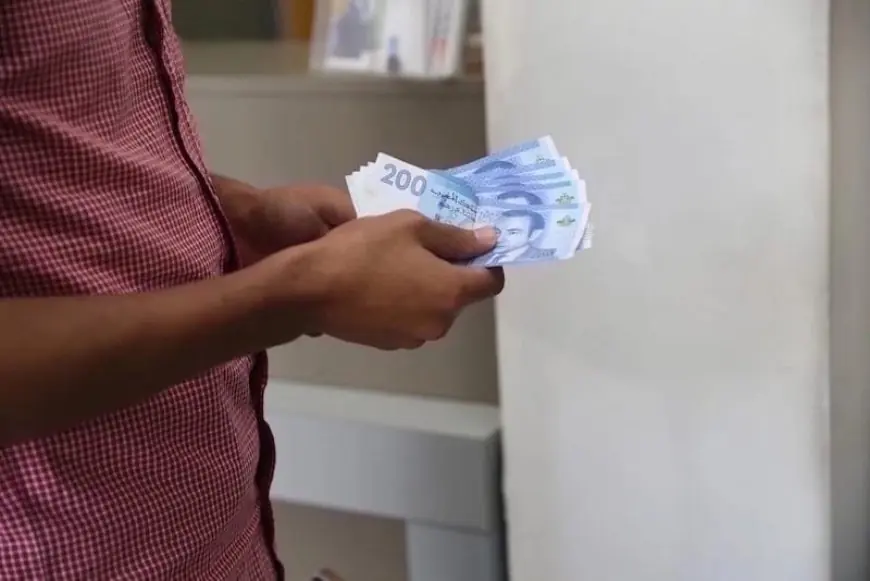

In a pioneering step that bridges Islamic law with contemporary economic realities, the Higher Scientific Council has adopted the official minimum wage (3,266 dirhams at the time of the fatwa’s issuance) as a key reference for estimating personal or family expenses in calculating zakat on income from the services sector. This comprehensive fatwa was issued today under the direct guidance of King Mohammed VI.

The fatwa, based on the Maliki school of thought with open ijtihad, clarifies that the services sector includes diverse incomes such as wages from public and private sector employees, health services, banking, insurance, communication, intellectual property rights, consulting, and the provision of utilities like electricity, water, waste management, arts, entertainment, advertising, and legal services.

Zakat is applicable to these incomes at a rate of one quarter of ten (2.5%) if the income reaches the nisab (7,438 dirhams based on the current value of silver), after deducting management costs and a lunar year has passed. The council adopted the minimum wage as a reference for expenses since it “provides a clear proposal based on ijtihad,” noting that leaving expenses undefined “allegedly due to people’s differing living costs would open up room for personal estimates,” and that this specification “benefits those with lower incomes more than those above them.”

The council also stated that “this reference may change” with official updates, making the fatwa a living tool for social solidarity.

Implementation:

- Assumption: An employee in the services sector (such as in communication or entertainment) earns 10,000 dirhams monthly (120,000 dirhams annually).

- Deduction: Minimum expenses = 3,266 dirhams × 12 months = 39,192 dirhams.

- Net Income: 120,000 – 39,192 = 80,808 dirhams.

- Nisab: If the net income exceeds 7,438 dirhams (nisab for silver), zakat is due = 80,808 × 2.5% = 2,020 dirhams.

In monthly calculations: 10,000 – 3,266 = 6,734 dirhams (less than the nisab, thus no monthly zakat, but annual accumulation is required). This makes the obligation fairer, especially in sectors such as arts or advertising, where management costs are included in the deduction.

Impact: A Call for Commitment in an Era of Economic Developments

The council emphasized that this reference strengthens the objective of zakat in purifying souls and achieving justice, especially with the statistical classification of poverty (absolute or relative, urban or rural). In the rapidly evolving services sector, which includes developments like intellectual property rights and digital entertainment, this contributes to combating social vulnerability, affirming that zakat is “a priority for meeting essential needs.”

The council invited individuals to consult its website regarding specific cases in “new income-generating activities.”